China's trade surplus topped $1 trillion for the first time as manufacturers seeking to avoid President Donald Trump's tariffs shipped more to non-U.S. markets in November, with exports to Europe, Australia and Southeast Asia surging.Shipments to the United States dropped by close to one-third from the same month a year before."The tariff cuts agreed under the U.S.

There are a few stories that I often tell when the subject of leadership in disasters is discussed. I figured I’d put them down on paper so I can stop repeating myself.It was pre OPA90, a single-skin tanker had run over a rock in the Port of New Jersey. It put a hole in the bottom

Stena Line has invested millions in extensive refurbishment and modernization of the Stena Germanica and Stena Scandinavica ferries on the Gothenburg–Kiel route. The renovation includes restaurant and bar areas as well as outdoor decks ahead of the com-ing travel season.Stena Line has carried out an extensive modernisation of the Stena Germanica and Stena Scandinavica ferries that operate on the

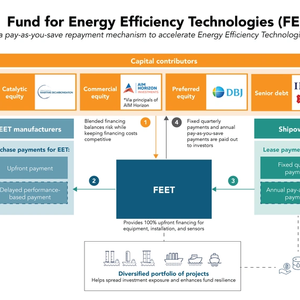

The Global Centre for Maritime Decarbonisation (GCMD), AIM Horizon Investments, and their partners have announced the successful closing of the Fund for Energy Efficiency Technologies (FEET), securing total commitments of up to $35 million, exceeding its initial target.As the world’s first fund for vessel retrofits leveraging a pay-as-you-save repayment mechanism

Tanker company DHT Holdings, Inc. has entered into a $308.4 million senior secured credit facility for the post-delivery financing of the company’s four newbuildings.The vessels are currently under construction at Hyundai Samho Heavy Industries and Hanwha Ocean, in South Korea and are scheduled for delivery during the first half of 2026.

“You cannot be a leader if you don’t know what is going on,” says Rik van Hemmen, President of marine consulting firm Martin & Ottaway.van Hemmen, writing in the June issue of Maritime Reporter magazine, recounts of some of his experiences in oil spill response to demonstrate that it’s a truth that is not always recognized.