The construction of Captain Arctic, a 69-meter near-zero-emission exploration vessel designed for sustainable cruising in polar waters, has reached a major milestone as its hull was completed by Goltens Dubai, marking the start of final outfitting and integration work.The vessel, owned by French company SELAR and built in collaboration with Chantier Naval de l’Océan Indien (CNOI) and Goltens

Green hydrogen developers are cancelling projects and trimming investments around the world, raising the prospect of longer than targeted reliance on fossil fuels.The challenges facing the sector have exposed its initial ambitions as unrealistic.Hard-to-electrify industries that were seen as ideal candidates for green hydrogen, such as steelmaking and long-distance transportation

Coal-fired power generation decreased 1.9% in 2025; non-fossil generation outpaces demand growthChina's coal-fired power generation decreased 1.9% in 2025, marking a historic shift driven by new non-fossil generation that has finally outpaced demand growth, according to a recent report from Wood Mackenzie.

Scottish engineering and consultancy firm Wood has secured a ten-year contract with NextDecade to deliver maintenance solutions at Rio Grande LNG, a major natural gas liquefaction and export facility under development near Brownsville in Texas.Wood will provide comprehensive maintenance services to support operations at the approximately 1,000-acre site.

Executives at two of Europe's top gas suppliers, ExxonMobil and QatarEnergy, on Monday warned they could stop doing business with the European Union if it does not significantly loosen a sustainability law that could impose fines of 5% of their global revenue.Exxon CEO Darren Woods told Reuters on the sidelines of the ADIPEC meeting in Abu Dhabi that the EU's Corporate Sustainability Due

VULKAN UK has provided the electrical design expertise and power profiles that enables the Silver Raven, the UK’s first fully electric sightseeing vessel, to begin operation in autumn 2025.Commissioned by Woods Tours, designed by One2Three Naval Architects, and built at Pendennis Shipyard in Cornwall, the 39-meter Silver Raven will carry up to 250 passengers per voyage.

A joint team from HII, Woods Hole Oceanographic Institution (WHOI), and the U.S. Navy’s Naval Undersea Warfare Center Division Newport (NUWC Division Newport) has successfully completed the first recovery of a second-generation REMUS 620 into a Virginia-class submarine torpedo tube and shutterway test fixture at Seneca Lake, New York.

Lloyd's Register (LR) has announced a milestone in its naval assurance services, having secured a 12-month in-service submarine support contract from the UK Ministry of Defence (MOD) through the Aurora Framework.Under the new contract, LR will provide experienced surveyors to His Majesty’s Naval Base Clyde, providing expert support to the Royal Navy’s submarines.

PETRONAS CCS Ventures Sdn. Bhd. (PCCSV) MISC Berhad (MISC), and Mitsui O.S.K. Lines, Ltd., (MOL) announced the incorporation of a strategic joint venture (JV), Jules Nautica Sdn. Bhd. This JV will lead the development and act as the ultimate owner of Liquefied Carbon Dioxide (LCO₂) carriers

A new report from Wood Mackenzie, "Trading cases: Tariff scenarios for taxing times", presents three futures for the global energy landscape, highlighting the far-reaching implications of ongoing trade tensions for the energy and natural resources sectors.The report presents three possible outlooks for the global energy and natural resources industries - Trade Truce (the most optimistic)

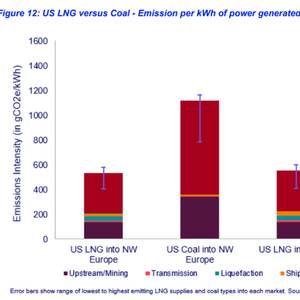

Wood Mackenzie has published a new report comparing the life cycle emissions of LNG with those of coal for power generation, finding the combustion of coal is related to significantly higher emissions.Wood Mackenzie’s analysis in the report titled 'Shining a light on the ‘coal versus LNG emissions’ debate' reveals the lifecycle emissions of U.S. LNG are typically around 48% of the coal equivalent.

According to its latest market outlook, Wood Mackenzie projects that Brent crude oil prices will average $73.00 per barrel (bbl) in 2025. The forecast considers geopolitical and economic factors, including potential peace talks between Russia and the US regarding the Ukraine conflict, ongoing tariffs, and sanctions against Iran.The outlook anticipates global oil demand to increase by 1.