The World Maritime University (WMU) has published a new report, In Search of a Sea-Life Balance in an Adverse Environment, shedding light on the realities of seafarers’ work, health and career intentions in today’s shipping industry. Commissioned by the Officers’ Union of International Seamen (OUIS), the study draws on responses from 4,372 seafarers representing 99 nationalities

If 2025 proved anything for Germany’s shipbuilding and marine equipment sector, it is that the industry retains both resilience and relevance, even amid geopolitical turbulence. According to The Association for Shipbuilding and Marine Technology (VSM), the year closed with strong order activity

Finnish engineering group Wärtsilä has agreed to divest its Gas Solutions business to German private equity investor Mutares SE & Co. KGaA, continuing its efforts to streamline operations and unlock value from its portfolio.Gas Solutions, which operates globally across the gas value chain, provides systems and lifecycle services for maritime gas handling, inert gas systems, gas-to-power solutions

Facility will include 150,000 square feet of covered manufacturing space optimized for serial productionNew yard will support 200 new jobs and expands shipbuilding capacity Master Boat Builders announced plans to build a new $60 million, 150,000 sq ft manufacturing facility dedicated exclusively to government and defense shipbuilding programs.

Fincantieri and the U.S. Navy have reached an agreement to redefine the future of the Constellation-class frigate program, ensuring work continues on the first two ships while cancelling four later units as part of a wider fleet review.The shift follows the Navy’s overhaul of its force-structure plans and aligns with new priorities aimed at accelerating next-generation ship designs and

After developing the technique some five years ago, Aker Arctic has now completed the research required to get its new design methodology for icebreaker hulls accepted into the Finish-Swedish Ice Class Rules. The method has also been adopted to Polar Class rules of several Class Societies (LR, ABS, DNV).

Terminal operators in a major oil port in east China's Shandong province are set to introduce measures to ban shadow fleet vessels and curb visits by other old tankers, according to an official notice seen by Reuters and a tanker tracker.The measures, to take effect from November 1, would ban vessels using fake IMO numbers and ships of 31 years or older

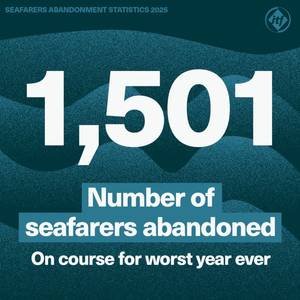

By May this year, 158 cases of vessel abandonment had been recorded, up from 119 at the same point in 2024.These cases represent more than 1,501 seafarers who have reached out to the ITF for assistance, many of whom were left unpaid, without food, water or access to ports, often for months at a time.“Abandonment is a growing, systemic problem,” said Stephen Cotton, ITF General Secretary.

Fincantieri and TUI Cruises, a joint venture between TUI AG and Royal Caribbean Cruises, have launched Mein Shiff Flow, a dual-fuel cruise ship newbuild.A sister ship to Mein Schiff Relax, delivered in February 2025, the new unit is scheduled to enter service in mid-2026.With approximately 160,000 gross tons

The global economy is bracing for renewed turbulence following U.S. President Donald Trump’s announcement on Wednesday of sweeping new tariffs, triggering fears of a global trade war and sparking immediate market and political reactions.According to the White House, the new measures include a 10% minimum tariff on most imported goods, with certain products - particularly those from major U.S.

We are at the one-year since the Francis Scott Key (FSK) Bridge collapsed over the Patapsco River’s Fort McHenry Channel in Baltimore, Maryland. Nearly 100 percent of the wreckage and debris removal was conducted by the Jones Act private sector U.S. maritime industry. The FSK collapsed at about 1:28 a.m.

[The following are exerpts and paraphrasing from testimony given by Matthew O. Paxton, President of the Shipbuilders Council of America (SCA), to Congress on the morning of February 26, 2025.]While maritime strength and shipbuilding historically have been a cornerstone of global power, shifting times and geopolitical pressures impact readiness and output.