The U.S. Coast Guard coordinated the rescue of 27 mariners on Saturday after their Venezuelan-flagged fishing vessel caught fire approximately 500 miles north-northwest of the Galapagos Islands, Ecuador.At 3:51 p.m. PST, Saturday, Rescue Coordination Center Alameda received a notification from the Garmin Search and Rescue Command Center of an SOS distress alert from the 240-foot fishing vessel

China's trade surplus topped $1 trillion for the first time as manufacturers seeking to avoid President Donald Trump's tariffs shipped more to non-U.S. markets in November, with exports to Europe, Australia and Southeast Asia surging.Shipments to the United States dropped by close to one-third from the same month a year before."The tariff cuts agreed under the U.S.

MPC Container Ships (MPCC) has entered into contracts with Jiangsu Hantong Ship Heavy Industry in China for the construction of four 4,500 TEU container vessels, scheduled for delivery starting first half of 2028.The contract price per vessel is $58 million and the agreement includes options for two additional vessels at the same price.

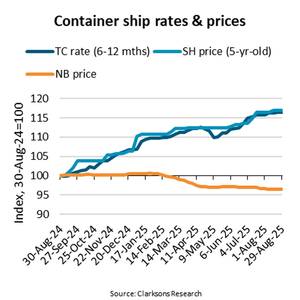

Despite significantly weaker freight rates, the average price for five-year-old container ships has increased 17% year-on-year and 6% since the beginning of 2025,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.The average per TEU price of a basket of seven five-year-old container ships was $9,761/TEU in late August 2024.

While global energy markets are not yet pricing in worst-case scenarios for the Israel-Iran war, oil tanker rates are providing a good real-time gauge of the escalating risks.Geopolitical risk has spiked following Israel's surprise bombardment of the Islamic Republic last Friday and Iran's retaliatory ballistic missile strikes, leading to a rally in global energy prices

When tensions rise in the Middle East, it can be helpful to look at what is not happening as much as what is.In the crude oil market, this means focusing on the fact that so far not a single barrel of crude oil supply has been lost. It is in the interests of all involved parties that this remains the case.

By the time Robbie Roberge spotted the fire consuming his boat's galley last August, he knew he had just minutes to evacuate his beloved Three Girls fishing vessel, named for his daughters.As the flames spread up the boat's walls, he helped his crew into safety suits, deployed a life raft and made a mayday call to alert nearby mariners and the U.S.

A.P. Møller Holding has, through its wholly owned subsidiary APMH Invest (APMHI), made an all-cash voluntary recommended purchase offer to the shareholders of Svitzer Group to acquire all issued and outstanding shares of the company.A.P. Møller Holding, through its wholly owned subsidiary APMHI, currently owns 47% of the share capital and voting rights of Svitzer.

Korea's Hanwha aims to buy up to 9.9% of Australian shipbuilder Austal in an after-market offer following its failed A$1.02 billion ($646.17 million) takeover bid last year, a term sheet showed on Monday.Hanwha has offered A$4.45 each for 41.2 million Austal shares, showed the term sheet reviewed by Reuters.

Europe soaked up most U.S. liquefied natural gas (LNG) exports for the second straight month in February, as cold weather and strong prices pushed up demand for the superchilled gas across the Atlantic, according to preliminary data from financial firm LSEG.The U.S. is the world's largest exporter of LNG and continues to play a major role in supplying Europe since Russia's invasion of Ukraine

The United States' first Jones Act-compliant offshore wind turbine installation vessel (WTIV), Charybdis, has started sea trials ahead of delivery to Dominion Energy planned for later in 2025.The Seatrium AmFELS shipyard in Bronsville, Texas, has been in charge of the construction of the WTIV vessel, the first of its kind to be build in the United States.

In what should be a surprise to no one, the Chinese maritime industry continued its dominance in 2024, with the nation’s vessel orderbook surpassing $123 billion. Data from VesselsValue reveals a strong year for both Chinese shipowners and shipbuilders, with significant investments across various vessel sectors.