On October 28, 2025 U.S. Senator Dan Sullivan (R-Alaska), Chairman of the Senate Committee on Commerce, Science, and Transportation’s Subcommittee on Coast Guard, Maritime, and Fisheries, convened the Senate hearing “Sea Change: Reviving Commercial Shipbuilding”. This hearing examined how to modernize and accelerate U.S.

A landmark agreement to curb billions of dollars in subsidies contributing to overfishing came into force on Monday, the World Trade Organization said - a move activists hailed as a step towards helping global fish stocks recover.It was the first agreement to take effect at the WTO since 2017 after years of stalled debates and infighting on top of, more recently, a surge in U.S.

Japan is likely to sweeten terms for developers to build a massive offshore wind farm sector, industry insiders say, as it looks to put its energy ambitions back on track against a worldwide slump of projects hit by soaring costs and delays.The government aims to have 45 gigawatts of offshore wind capacity by 2040

The rhythmic clang of hammers and the bright flashes of welding torches filled the air at Skaramangas Shipyard near Athens last month, as workers busily repaired the bow of a large tanker. Nearby, other vessels awaited their turn in the dry dock—an unmistakable sign of renewed activity at the once-idle shipyard.

The chairman of Italy's Leonardo on Monday floated the idea of a future combination between the defence and aerospace group and state‑controlled shipbuilder Fincantieri.Speaking at a conference at Milan's Bocconi University, Stefano Pontecorvo told an audience that he hoped the two groups could one day merge, addressing his remark to Claudio Cisilino

In a move that underscores how quickly artificial intelligence is moving from pilot projects to production systems in global shipping, Ocean Network Express (ONE) and MTI Ltd. have established a new joint venture, QUAVEO Company Limited, aimed squarely at fast-tracking digital transformation (DX) across maritime operations.

Offshore wind developers and equipment suppliers are bracing for a slowdown in business in France where a political crisis has stalled changes to the country's energy framework and government tenders.The threat of a further hit to France's economy comes after data released on Friday shows business activity declined faster than expected in October.

BP has won its arbitration case against Venture Global over the U.S. supplier's failure to deliver liquefied natural gas under a long-term contract that was due to start in late 2022, Venture Global said on Thursday.The International Chamber of Commerce International Court of Arbitration found that Venture Global breached its obligations to declare commercial operations had begun at the

dship Carriers from Hamburg has selected Liebherr’s LS 250 heavy-duty cranes to equip at least four of the ships in its fleet.The LS 250 cranes are designed to comply with the requirements of the St. Lawrence Regulations. These regulations apply to ships navigating the St. Lawrence Seaway and connecting the Great Lakes in Canada with the Atlantic Ocean.

Amid ongoing maritime tensions, the Philippines signaled it is open to exploring new agreements with China aimed at preserving peace in the contested South China Sea, Foreign Affairs Secretary Enrique Manalo said Sunday during an ASEAN summit in Kuala Lumpur.“Anything within the scope of diplomatic or peaceful means, or cooperation, is certainly within our template,” Manalo noted

LS Eco Advanced Cables (LSEAC) has launched a five-week public consultation on its proposals to develop a high voltage cable production facility at the Port of Tyne for subsea electricity transmission, designed to transport clean energy generated by offshore wind onto UK shores.While plans are at an early stage and still being finalized, total investment is expected to be approximately $1.

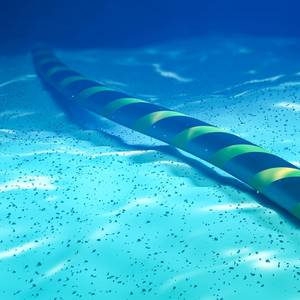

A project on a subsea power cable to link continental Europe to the East Mediterranean will materialize, Greek foreign minister said on Thursday after meeting his Israeli and Cypriot counterparts.Media reports earlier this week suggested that the project had stalled over territorial differences.Greek power grid operator IPTO ADMr.