As oil exploration and production goes, so goes the market for Offshore Service Vessels (OSVs) and Platform Supply Vessels (PSVs). Throughout 2025, the prices of oil- which drives exploration and production (E & P), have softened, moving down towards $60/barrel amidst economic uncertainty and a wider than anticipated opening of the taps by major oil producers.

The captain of a container ship that crashed into a U.S. tanker off Britain's east coast last year was jailed for six years on Thursday for causing the death of a crew member through gross negligence.Russian national Vladimir Motin, 59, was captain of the Portuguese-flagged Solong when it hit the Stena Immaculate tanker, which was anchored and carrying just over 220

This past year won’t soon be forgotten. In 2025, conventional thinking about economics and investor behavior was frequently challenged, as dramatic changes in technology, energy and geopolitics drove markets in often unexpected ways.As the clock turns to 2026, here are 8 general market movers that can help explain what happened in 2025 and what it might mean for 2026 and beyond.1.

The United States on Thursday issued new sanctions targeting Venezuela, imposing curbs on three nephews of President Nicolas Maduro's wife, as well as six crude oil tankers and shipping companies linked to them, as Washington ramps up pressure on Caracas.The action came as the U.S. executes a large-scale military buildup in the southern Caribbean and as U.S.

U.S. energy firms this week added oil and natural gas rigs for a third week in a row for the first time since February, energy services firm Baker Hughes said in its closely followed report on Friday.The oil and gas rig count, an early indicator of future output, rose by three to 542 in the week to September 19, its highest since July.

Baker Hughes has signed a multi-year contract with Petrobras to extend deployment of its Blue Marlin and Blue Orca stimulation vessels, supporting offshore oil and gas production in Brazil’s post and pre-salt fields.The award, which followed an open tender, also covers the supply of associated chemicals and services.

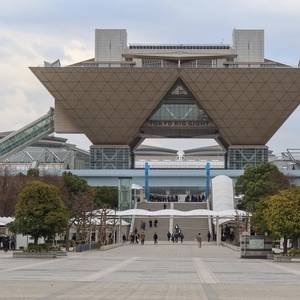

From June 18-20, 2025, the Japan Energy Summit & Exhibition will return to Tokyo Big Sight, convening global energy leaders, influential policymakers, and industry executives to advance Japan’s energy transition, investment landscape, and strategic role in the global energy system.

Captain Vladimir Motin was sentenced to six years’ jail on February 2 after being found guilty of “gross negligence manslaughter” for his role in the container ship Solong’s ramming of the anchored tanker Stena Immaculate in March 2025.The circumstances of his case, heard at the Old Bailey in London, are different to those of Ali Albokhari, currently serving a 30-year term in a Turkish jail

War insurance costs for ships sailing to the Black Sea have spiked again, with insurers reviewing policies daily as the conflict in Ukraine spills into sea lanes, five shipping and insurance sources said on Thursday.The Black Sea is crucial for the shipment of grain, oil and oil products. Its waters are shared by Bulgaria, Georgia, Romania and Turkey, as well as Russia and Ukraine.

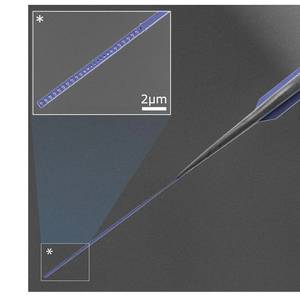

Researchers from Australia’s University of Queensland have made a microscopic “ocean” on a silicon chip to miniaturise the study of wave dynamics.The device, made at UQ’s School of Mathematics and Physics, uses a layer of superfluid helium only a few millionths of a millimetre thick on a chip smaller than a grain of rice.

Australia-based Provaris Energy has signed an agreement with global energy technology company Baker Hughes.The collaboration marks a significant step forward in the development and deployment of compressed hydrogen solutions for marine transportation and storage, leveraging Provaris’ proprietary H2Leo Barge and H2Neo Carrier alongside Baker Hughes’ compression expertise.

Baker Marine Solutions (BMS) announced a formal partnership with Seacroft Marine Consultants (EMEA) and M3 Marine Expertise (Asia-Pacific) through a signed Memorandum of Understanding (MOU).After establishing a working relationship in recent years, this tri-party alliance formally marks a milestone in enabling cross-regional delivery of Marine Assurance, Marine Warranty