A newly built very large gas carrier (VLGC) was named Lucent Pathfinder at a ceremony held at Kawasaki Heavy Industries’ Sakaide Works, marking the seventh dual-fuel LPG carrier using LPG ordered by NYK.The vessel, which will be chartered by United Arab Emirates-based LPG trader BGN INT DMCC

The United States is attempting to seize a Russian-flagged oil tanker with links to Venezuela after a more than two-week-long pursuit across the Atlantic and as a Russian submarine and warship were close by, two U.S. officials told Reuters on Wednesday.The seizure, which could stoke tensions with Russia, came after the tanker, originally known as the Bella-1, slipped through a U.S.

Britain targeted Russia's two largest oil companies, Lukoil and Rosneft, and 44 shadow fleet tankers on Wednesday in what it described as a new bid to tighten energy sanctions and choke off Kremlin revenues.Lukoil and Rosneft were designated under Britain's Russia sanctions laws for what London described as their role in supporting the Russian government.

Terminal operators in a major oil port in east China's Shandong province are set to introduce measures to ban shadow fleet vessels and curb visits by other old tankers, according to an official notice seen by Reuters and a tanker tracker.The measures, to take effect from November 1, would ban vessels using fake IMO numbers and ships of 31 years or older

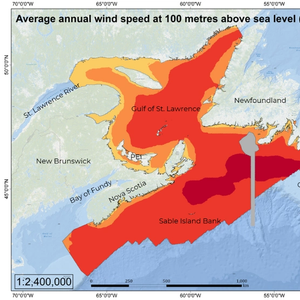

Sean Fraser, Canada’s Minister responsible for the Atlantic Canada Opportunities Agency, has announced that strategic direction has been given to the Canada–Nova Scotia Offshore Energy Regulator as a next step toward realizing Canada’s first-ever offshore wind project.Fraser made the announcement on behalf of Tim Hodgson, Canada’s Minister of Energy and Natural Resources

The Shell-led LNG Canada facility has produced its first LNG for export in Kitimat, British Columbia, a spokesperson for the project confirmed on Sunday.The milestone comes in advance of the facility loading its first LNG export cargo, which LNG Canada said it remains on track to do by the middle of this year.

A fatal incident has occurred aboard one of the vessels of Tidewater, a subcontractor of Equinor, resulting in the death of a crew member.The incident took place on Polaris platform supply vessel (PSV) on June 2, 2025, while the vessel was on the Atlantic Ocean engaged in normal operations.

Traders have rebranded more than $1 billion of Venezuelan oil shipments to China as Brazilian crude over the past year, according to two tanker tracking firms, company documents and four traders, helping buyers to cut logistics costs and circumvent U.S. sanctions.Independent refiners in China are the main buyers of seaborne oil shipments from countries sanctioned by the United States

On World Donkey Day (May 8), international animal welfare charity, The Donkey Sanctuary, acknowledges Swire Shipping as the first global shipping line to commit publicly to a ‘No Donkey Skins Carriage policy’.In February last year, African Heads of State and Governments endorsed a continent-wide moratorium on the slaughter of donkeys for their skins at the 37th African Union Summit.

Odfjell’s chemical tanker Bow Olympus is currently crossing the Atlantic powered by a combination of wind-assisted propulsion and a certified sustainable 100% biofuel, marking the company’s first near carbon-neutral transatlantic voyage.Real-time data from the voyage confirms that the dual propulsion approach is both technically feasible and impactful

The seventh generation Atlantic Zonda drillship, managed by Ventura Offshore Midco, has started operations for Petrobras under a three-year drilling contract.The Atlantic Zonda is managed by Ventura Offshore through marketing and operating agreements with the rig owner, Eldorado Drilling, and the company will earn its management fees and reimbursable revenues from these agreements.

U.S. President Donald Trump’s regulatory freeze has injected chaos and uncertainty into a number of lucrative American fisheries, raising the risk of a delayed start to the fishing season for some East Coast cod and haddock fleets and leading to overfishing of Atlantic bluefin tuna, according to Reuters interviews with industry groups and federal government employees.