Vessels owned or operated by U.S. firms and individuals - or those built in the United States or that fly the U.S. flag - will be charged additional port fees per voyage starting on October 14, China's transport ministry said.The fees are a counter-measure against upcoming U.S. port fees on Chinese ships, the ministry said on Friday.

"During the first six weeks of 2026, global bulk grain shipments have jumped 15% y/y, supported by a 30% y/y surge in soya bean shipments and a 17% increase in wheat shipments. Record harvests in the Southern Hemisphere are boosting exports while North America has continued to ship its high export surplus.

Ivory Coast, the world's biggest cocoa producer, has sold 1.3 million tons of cocoa contracts for the 2025/26 October to March main crop, down from 1.4 million tons last year, amid concerns over declining harvests and production, two Coffee and Cocoa Council (CCC) sources told Reuters on Thursday.

“Following US-China trade negotiations, China has committed to resume imports of US soya beans. The country has agreed to purchase 12m tonnes during the rest of 2025 and 25m tonnes per year during the next three years, similar to 2024 volumes. If these commitments are met, US soya bean shipments are expected to surge in the short term before stabilizing in the medium term,” says Filipe Gouveia

Vessels owned or operated by U.S. firms and individuals, or those built in the United States or that fly the U.S. flag, will be charged additional port fees per voyage starting on Tuesday, China's transport ministry said.The fees are a countermeasure against upcoming U.S. port fees on Chinese ships, the ministry said on Friday.

“During the first half of 2025, US seaborne grain shipments increased 9% y/y, driven by stronger maize exports. While an increase in import tariffs led to a 57% y/y drop in volumes to China, the US has been able to find alternative markets for most of its cargoes,” says Filipe Gouveia, Shipping Analysis Manager at BIMCO.

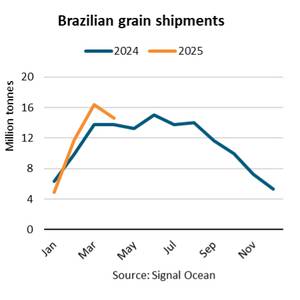

Between January and April 2025, Brazilian grain shipments rose 9% y/y, supported by strong Chinese purchasing, according to Filipe Gouveia, Shipping Analysis Manager at BIMCO.The ramp-up in exports has been supported by a 9% increase in the soya bean harvest, according to estimates by the United States Department of Agriculture (USDA).

Ivory Coast's cocoa grind dropped 31.2% year-on-year in July to 39,301 metric tons, data from exporters' association GEPEX showed on Monday, with grinders citing poor bean quality and low volumes of the mid-crop.The total grind - part of the process of transforming cocoa beans into chocolate - from the start of the 2024/25 season in October until the end of July stood at 515,055 tons of beans