China's trade surplus topped $1 trillion for the first time as manufacturers seeking to avoid President Donald Trump's tariffs shipped more to non-U.S. markets in November, with exports to Europe, Australia and Southeast Asia surging.Shipments to the United States dropped by close to one-third from the same month a year before."The tariff cuts agreed under the U.S.

By Captain Bobbie Scolley, U.S. Navy (ret.) and Rear Admiral Tim Gallaudet, U.S. Navy (ret.)For more than six decades, spanning from 1905 to the late 1970s, the U.S. Navy’s diving apparatus for deep ocean operations and salvage remained fundamentally unchanged. During this period, the demographic of navy divers also saw little alteration.

Green hydrogen developers are cancelling projects and trimming investments around the world, raising the prospect of longer than targeted reliance on fossil fuels.The challenges facing the sector have exposed its initial ambitions as unrealistic.Hard-to-electrify industries that were seen as ideal candidates for green hydrogen, such as steelmaking and long-distance transportation

Rigs drilling beneath the deep waters of the Gulf of Mexico will drive U.S. oil industry growth this year and next as onshore production slows due to lower prices and maturing shale fields, and analysts and consultants expect the trend to continue as new technology and friendly regulations attract investment offshore.

Nippon Yusen Kabushiki Kaisha (NYK) has completed a joint demonstration with Singapore-based Global Centre for Maritime Decarbonisation (GCMD) that verified the long-term use and storage of biofuel onboard ships, confirming its technical safety and sustainable usability.The six-month trial, as part of Project LOTUS, involved continuous use of B24 biofuel on a pure car and truck carrier.

Hanwha Ocean, one of the leading shipbuilders in South Korea, has awarded ABB the contract to supply a complete electric power and propulsion system for Singapore’s first floating liquefied natural gas (LNG) terminal.ABB ’s integrated electrical system on board the Floating Storage and Regasification Unit (FSRU) will comprise a medium voltage generator, 6.

MARL International, part of Glamox, a global leader in lighting, announced today that it is partnering with Canadian firm Apex Industries, which will manufacture its marine lighting systems under license in Canada for three destroyers for the Royal Canadian Navy (RCN). Apex Industries was awarded the lighting systems contract by Irving Shipbuilding

A new report from Wood Mackenzie, "Trading cases: Tariff scenarios for taxing times", presents three futures for the global energy landscape, highlighting the far-reaching implications of ongoing trade tensions for the energy and natural resources sectors.The report presents three possible outlooks for the global energy and natural resources industries - Trade Truce (the most optimistic)

U.S. Defense Secretary Pete Hegseth reaffirmed the United States' unwavering commitment to its decades-old defense treaty with the Philippines during a visit to Manila on Friday, pledging to bolster the alliance with advanced military capabilities in the face of increasing tensions with China. Meeting with Philippine Defense Secretary Gilberto Teodoro and President Ferdinand Marcos Jr.

BP is exploring the sale of minority stakes in two of its most valuable Gulf of Mexico oil projects — Kaskida and Tiber — as the energy giant recalibrates its strategy to prioritize oil and gas, according to two sources familiar with the matter.The potential divestments could involve selling up to 50% of each project, which are estimated to be worth billions of dollars, the sources said.

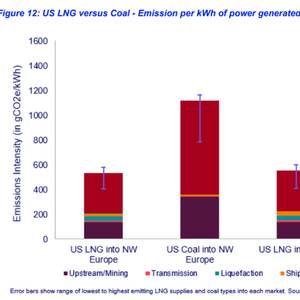

Wood Mackenzie has published a new report comparing the life cycle emissions of LNG with those of coal for power generation, finding the combustion of coal is related to significantly higher emissions.Wood Mackenzie’s analysis in the report titled 'Shining a light on the ‘coal versus LNG emissions’ debate' reveals the lifecycle emissions of U.S. LNG are typically around 48% of the coal equivalent.

According to its latest market outlook, Wood Mackenzie projects that Brent crude oil prices will average $73.00 per barrel (bbl) in 2025. The forecast considers geopolitical and economic factors, including potential peace talks between Russia and the US regarding the Ukraine conflict, ongoing tariffs, and sanctions against Iran.The outlook anticipates global oil demand to increase by 1.