The Panama Canal marked a significant milestone on Monday with the inaugural transit of the Neopanamax cruise ship, Disney Adventure, the largest passenger vessel by capacity and gross tonnage ever to transit the interoceanic waterway.The passage of the ship, 208,000 gross tons and with capacity for approximately 6,700 passengers, took place as part of her positioning voyage.

HD Korea Shipbuilding & Offshore Engineering (HD KSOE), the intermediate holding company for HD Hyundai's shipbuilding business, has signed a shipbuilding contract with HMM for eight 13,400-TEU dual-fuel container ships.The vessels ordered are 337 meters in length, 51 meters in width, and 27.9 meters in height.

Mavrik Marine, Inc. was selected to build high-speed passenger ferries for the Golden Gate Bridge Highway & Transportation District. Mavrik will construct catamaran passenger ferries as part of the District’s eight vessel Lima Class Ferry Replacement Program to provide transportation services in San Francisco Bay.

Petrodec’s newly constructed heavy lift jack-up vessel, named Obana, has started decommissioning work in the Southern North Sea for Perenco.Obana is working on the decommissioning of the Galahad platform, after which it will move to the Amethyst field for the removal of the C1D, A2D and B1D jackets, expected to be completed and offloaded in the Netherlands later in 2025.

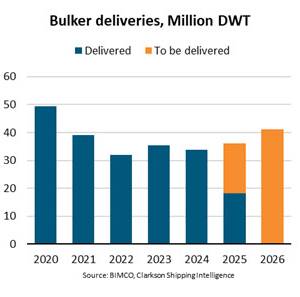

“We forecast that bulker deliveries will gradually increase this year and in 2026, reaching 41.2m Deadweight Tonnes (DWT) and a six-year high. Bulker newbuilding contracting was strong in 2023 and 2024, and several of the ships ordered during this period are expected to be delivered during this and next year,” says Filipe Gouveia, Shipping Analysis Manager at BIMCO.Of the 59.

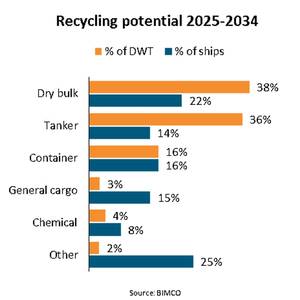

“As the Hong Kong International Convention for the Safe and Environmentally Sound Recycling of Ships (Hong Kong Convention) enters into force we have updated our estimate for the ship recycling potential over the next 10 years. We now estimate the potential to be 16,000 ships, or 700m deadweight tonnes (DWT), from previously 15,000.

The offshore rig market recovery appears to have taken a pause, with demand tapering off and marketed utilization hitting the lowest levels recorded since recovery began in 2021. A variety of factors have contributed to this – including Saudi Aramco’s suspension of over 30 jackup contracts by up to one year, the entry of newbuild rigs into the market without work to go to

Beijing increased its tariffs on U.S. imports to 125% on Friday, hitting back against U.S. President Donald Trump's decision to hike duties on Chinese goods and raising the stakes in a trade war that threatens to up-end global supply chains.China's retaliation intensified the economic turmoil unleashed by Trump's tariffs

Louis Dreyfus Armateurs (LDA) and InfraVia, a private equity company in Europe, have entered into exclusive negotiations for InfraVia to acquire a majority stake in LDA, a group specializing in high value-added industrial marine services.LDA currently specializes in three growing segments, transportation and logistics of industrial equipment, mainly through dedicated Ro-Ro vessels

The term gamechanger is often over used enough to be rendered meaningless, but the huge Simandou mine in the West African country of Guinea is going to be just that as its start up is set to rock the seaborne iron ore market.The first cargoes from the project may arrive by the end of this year and it's expected that it will ramp up to its full capacity of 120 million metric tons per annum fairly

Austal Limited said that Austal Australasia has been awarded a contract valued between A$265 and A$275 million by Gotlandsbolaget of Sweden for the design and construction of a 130-m combined cycle, ‘hydrogen-ready’ vehicle passenger ferry. Part of Gotlandsbolaget’s ‘Horizon X’ program, the high-speed ROPAX catamaran will be the largest vessel ever constructed by Austal, and feature a unique

The Baltic states of Estonia, Latvia and Lithuania completed a switch from Russia's electricity grid to the EU's system on Sunday, severing Soviet-era ties amid heightened security after the suspected sabotage of several subsea cables and pipelines.European Commission President Ursula von der Leyen hailed the move, years in the planning, as marking a new era of freedom for the region