Norwind Offshore has taken delivery delivery of Norwind Maestro commissioning service operations vessel (CSOV) from Vard Søviknes, further expanding its managed fleet and reinforcing long-term commitment to supporting offshore wind farm operations.The 85-meter long Norwind Maestro CSOV has become the sixth vessel in Norwind Offshore’s fleet.

China's trade surplus topped $1 trillion for the first time as manufacturers seeking to avoid President Donald Trump's tariffs shipped more to non-U.S. markets in November, with exports to Europe, Australia and Southeast Asia surging.Shipments to the United States dropped by close to one-third from the same month a year before."The tariff cuts agreed under the U.S.

Davie, a leader in icebreaker and specialized vessel construction, announced plans to acquire shipbuilding assets in Galveston and Port Arthur from Gulf Copper & Manufacturing Corporation — marking a major step toward revitalizing large-scale shipbuilding of icebreakers in the United States. The move underscores growing momentum behind domestic production of ice-capable vessels and aligns with U.

Mitsui O.S.K. Lines (MOL) has taken delivery of the Kohzan Maru VII, a newbuilding dual-fuel methanol carrier, which will serve Mitsubishi Gas Chemical Company (MGC) under a long-term charter.The Kohzan Maru VII was delivered at HD Hyundai Mipo shipyard, where the naming ceremy took place.

Japan is likely to sweeten terms for developers to build a massive offshore wind farm sector, industry insiders say, as it looks to put its energy ambitions back on track against a worldwide slump of projects hit by soaring costs and delays.The government aims to have 45 gigawatts of offshore wind capacity by 2040

The Mexican ship which crashed into New York's Brooklyn Bridge over the weekend did not make distress calls before ramming into the bridge, the head of Mexico's navy said on Tuesday, but rather called for support.Navy chief Raymundo Morales, speaking at Mexican President Claudia Sheinbaum's morning press conference

The investigation into why a Mexican Navy training ship struck the Brooklyn Bridge on Saturday, shearing the top of its masts, will look into a possible engine failure and the role of a tug boat that assisted it in backing out of its pier, officials said on Monday.The ship's engine was the key focus for the National Transportation Safety Board, said Brian Young

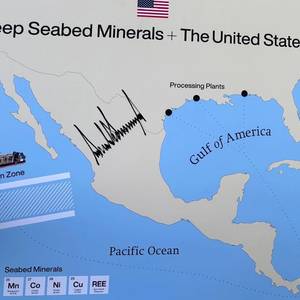

Deep-sea mining firm The Metals Co asked the Trump administration on Tuesday to approve its plans to mine the international seabed, making it the first such company to seek the government's permission to operate outside U.S. territorial waters.Last week President Donald Trump signed an order aiming to jumpstart mining in both domestic and international waters in an attempt to boost U.S.

Beijing increased its tariffs on U.S. imports to 125% on Friday, hitting back against U.S. President Donald Trump's decision to hike duties on Chinese goods and raising the stakes in a trade war that threatens to up-end global supply chains.China's retaliation intensified the economic turmoil unleashed by Trump's tariffs

The United States will "take back" the Panama Canal from Chinese influence, U.S. Defense Secretary Pete Hegseth said on Tuesday during a visit to the Central American nation.After talks with Panama's government, Hegseth vowed to deepen security cooperation with Panamanian security forces and said China would not be allowed to "weaponize" the canal by using Chinese firms' commercial relationships

The White House is weighing an executive order that would fast-track permitting for deep-sea mining in international waters and let mining companies bypass a United Nations-backed review process, according to two sources with direct knowledge of the deliberations.If signed, the order would mark U.S.

The rhythmic clang of hammers and the bright flashes of welding torches filled the air at Skaramangas Shipyard near Athens last month, as workers busily repaired the bow of a large tanker. Nearby, other vessels awaited their turn in the dry dock—an unmistakable sign of renewed activity at the once-idle shipyard.