A sanctioned liquefied natural gas (LNG) tanker made a ship-to-ship (STS) transfer off the coast of Malaysia after picking up a cargo from a Russian export terminal also under Western restrictions, according to two analytics firms.The operation appears to be the first known STS transfer of sanctioned Russian LNG, despite Western efforts to curb Moscow's energy revenues over its war in Ukraine.

Colonna’s Shipyard, Inc. (CSI) will invest $70m to acquire its fourth drydock, expected to have a lifting capacity of 25,000 tons and slated for delivery in the first half of 2028.“This new drydock acquisition is a testament to our continued dedication to innovation, quality service, and our steadfast investment in the future,” said Randall Crutchfield, Chairman & CEO, at Colonna’s Shipyard, Inc.

Davie Defense Inc. gives a first glimpse today of the “American Icebreaker Factory” – a planned $1 billion transformation of the historic Gulf Copper shipyard in Galveston, Texas.The American Icebreaker Factory concept was created in collaboration with Florida-based Pearlson, which has led major projects for leading American shipbuilders, including BAE Systems

Eastern Shipbuilding Group received the Notice to Proceed from Washington State Ferries (WSF) to build two with an option for an additional 160-vehicle hybrid-electric ferries for the State of Washington. This milestone follows the first competitive bid for ferry construction in more than 25 years for the nation’s largest ferry system.

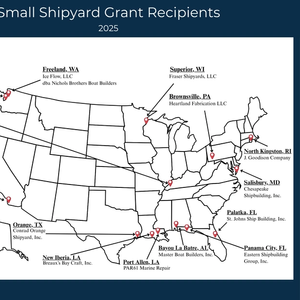

U.S. Transportation Secretary Sean P. Duffy has announced that the Maritime Administration (MARAD) has awarded $8.75 million in grants to revitalize U.S. shipyards and advance America’s maritime dominance.The funding is part of the Small Shipyard Grant program, which supports advanced training, workforce development and new technologies that strengthen U.S. shipbuilding and repair capabilities.

ABS awarded approval in principle (AiP) to Overseas Shipholding Group, Inc. (OSG), the parent company of Aptamus Carbon Solutions, for its preliminary design of a liquefied carbon dioxide (LCO2) barge.The development of the barge design is a core component of the Tampa Regional Intermodal Carbon Hub (T-RICH) project to receive

The Unified Command, consisting of the US Coast Guard, Spectrum OpCo (Operator), and the Louisiana Oil Spill Coordinator's Office (LOSCO), continue to respond an oil and natural gas release in coastal Louisiana.This spill occurred on April 26 in a marsh environment near the Garden Island Bay Production Facility company's well in Plaquemines Parish, southeast of New Orleans, Louisiana.

Inmarsat Maritime, a Viasat company, has announced Caribe Tankers USA, Inc (CTU) will trial Inmarsat’s fully managed bonded connectivity service, NexusWave, on board the chemical tankers Caribe Maria and Caribe Luna as the company seeks a reliable solution to best serve operational and crew connectivity.

Europe soaked up most U.S. liquefied natural gas (LNG) exports for the second straight month in February, as cold weather and strong prices pushed up demand for the superchilled gas across the Atlantic, according to preliminary data from financial firm LSEG.The U.S. is the world's largest exporter of LNG and continues to play a major role in supplying Europe since Russia's invasion of Ukraine

Kraken Robotics Inc. announced the passing of founder and former CEO, Karl Kenny on February 11, 2025, at the age of 64. Karl founded Kraken in 2012 and was instrumental in building the company into a leading player in subsea robotics over his 10-year tenure, before retiring in December 2022.

CORE POWER (US) Inc. has engaged with Glosten to help its team design a floating nuclear power plant (FNPP) to power U.S. ports. Created by CORE POWER, the FNPP concept is a nearshore infrastructure system that includes a barge-based nuclear power plant, barge support services, electrical grid integration, and operational teams.

The bipartisan, bicameral bill will fuel U.S. economy, strengthen national security by responding to China’s threat over the oceans. Currently, the number of U.S.-flagged vessels in international commerce is 80; China has 5,500.Today, Senator Mark Kelly (D-AZ), Senator Todd Young (R-IN), Representative John Garamendi (D-CA-8)