Swan Defence and Heavy Industries (SDHI) has signed its first newbuild contract for six IMO Type II chemical tankers, marking a milestone for India’s commercial shipbuilding sector and the country’s first chemical tanker order placed with a domestic shipyard.The contract, valued at $227 million, was awarded by European shipowner Rederiet Stenersen AS and covers six 18

If 2025 proved anything for Germany’s shipbuilding and marine equipment sector, it is that the industry retains both resilience and relevance, even amid geopolitical turbulence. According to The Association for Shipbuilding and Marine Technology (VSM), the year closed with strong order activity

Singapore-based engineering group Seatrium has reported strong execution in the third quarter ended September 30, 2025, bolstered by major offshore and wind project deliveries, a high-value order book and strategic asset sales.The group’s net order book stood at about $12.8 billion (S$16.6 billion), covering 24 projects slated for delivery through 2031.

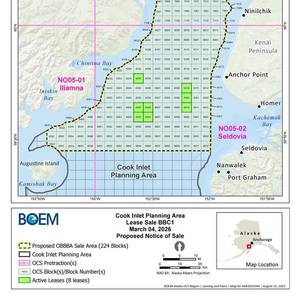

The Trump administration will hold an auction for drilling oil and gas off the U.S. Gulf next month and has proposed another in a waterway in southern Alaska, it said on Friday.The lease sale in the U.S. Gulf of Mexico, which President Donald Trump refers to as the Gulf of America, will make about 80 million acres available.

St. Catharines, Ontario–based Algoma Central Corporation (TSX: ALC) reported a solid third quarter for 2025, marked by fleet milestones, steady revenue growth across segments, and ongoing investment in next-generation vessels.For the quarter ended September 30, Algoma posted revenue of C$228 million, up from C$205 million a year earlier, and EBITDA of C$89.7 million, a 19% increase year-over-year.

Japan's second-largest shipping company Mitsui O.S.K. Lines wants to tie up with Indian companies to build tankers in India, aiding the South Asian nation's effort to boost local manufacturing, its chief executive, Takeshi Hashimoto said.New Delhi is modernizing its maritime laws to allow foreign participation in the sector, including ship-building, ports and shipyards

New Wave Media, a leading B2B media company serving the global maritime, offshore energy, subsea and logistics sectors, acquired the Port of the Future Conference & Exhibition, a premier international symposium known for its focus on advancing port infrastructure, technology, and policy.

Yinson Production, via its joint venture PTSC South East Asia (PTSC SEA), has secured a lease and operate contract for a new floating storage and offloading (FSO) unit for Vietnam’s offshore Block B gas development.The contract was awarded by Phu Quoc Petroleum Operating Company (PQPOC), the operator of Blocks B 48/95 and 52/97, on behalf of state-run Petrovietnam.

The U.S. Coast Guard welcomed the nearly $25 billion investment included in the One Big Beautiful Bill Act Friday — marking the largest single commitment of funding in service history. The investment strengthens every facet of Coast Guard operations and supports the Service's role as the Nation’s leading drug interdiction and maritime border security force.

Ordering of alternative-fueled vessels is continuing to grow in 2025, despite a slowdown in the overall newbuild market. According to data from DNV’s Alternative Fuels Insight (AFI) platform, new orders for alternative-fueled vessels reached 19.8 million gross tonnes (GT) in the first six months of 2025, exceeding the 2024 figure by 78%.

Seatrium delivered the Floating Production Storage and Offloading vessel (FPSO), BW Opal, to BW Offshore."We would like to express our appreciation to BW Offshore for entrusting Seatrium with their projects over the years," said Marlin Khiew, EVP, Energy (Americas), Seatrium. "The successful completion and delivery of BW Opal marks our 18th FPSO for BW Offshore.

Europe soaked up most U.S. liquefied natural gas (LNG) exports for the second straight month in February, as cold weather and strong prices pushed up demand for the superchilled gas across the Atlantic, according to preliminary data from financial firm LSEG.The U.S. is the world's largest exporter of LNG and continues to play a major role in supplying Europe since Russia's invasion of Ukraine