Supertanker costs in the Middle East have hit all-time highs, according to shipping data and industry sources on Tuesday, as the U.S.-Iran conflict intensifies with Tehran attacking ships passing through the Strait of Hormuz.Shipping through the Strait between Iran and Oman, which carries around one-fifth of oil consumed globally as well as large quantities of liquefied natural gas

Maritime 2026 opened with a bang between the announcement of Battleships, Venezuela, shadow fleets and yes, U.S. shipbuilding. The commercial building issue may come down to strategic patience or the adaptability to evolve through new technology while ignoring historic, old tactics.

One of Australia's biggest coal export ports will resume operations on Monday, the port operator said, after climate-change protesters disrupted shipping at the Port of Newcastle for a second day on Sunday.Climate activist group Rising Tide, which claimed responsibility for the latest protest, said hundreds of activists paddled kayaks into the shipping lane of Newcastle Harbour on Sunday morning

German container shipping firm Hapag-Lloyd on Thursday posted a 50% drop in nine-month net profit to 846 million euros ($986.6 million) and lowered the top end of its full-year earnings outlook, citing market volatility and rising costs.The company narrowed its full-year earnings before interest and taxes (EBIT) forecast to between 0.5 billion and 1.

The number of people confirmed dead after a boat carrying members of Myanmar's persecuted Rohingya community sank near the Thailand-Malaysia border rose to 11 on Monday, authorities said, with about 70 people believed to have been on board the capsized vessel.The status of another boat carrying 230 passengers remained unclear, Malaysian authorities said

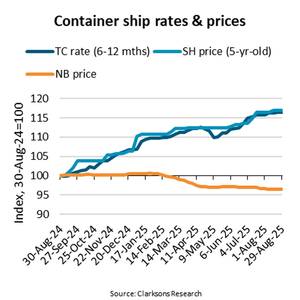

Despite significantly weaker freight rates, the average price for five-year-old container ships has increased 17% year-on-year and 6% since the beginning of 2025,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.The average per TEU price of a basket of seven five-year-old container ships was $9,761/TEU in late August 2024.

While global energy markets are not yet pricing in worst-case scenarios for the Israel-Iran war, oil tanker rates are providing a good real-time gauge of the escalating risks.Geopolitical risk has spiked following Israel's surprise bombardment of the Islamic Republic last Friday and Iran's retaliatory ballistic missile strikes, leading to a rally in global energy prices

When tensions rise in the Middle East, it can be helpful to look at what is not happening as much as what is.In the crude oil market, this means focusing on the fact that so far not a single barrel of crude oil supply has been lost. It is in the interests of all involved parties that this remains the case.

The global maritime sector is entering an era of heightened geopolitical and regulatory uncertainty that threatens to offset long-term safety gains, according to Allianz Commercial’s 2025 Safety and Shipping Review. While vessel losses have reached a record low, the industry faces a volatile landscape shaped by trade conflict, increased sanctions, shadow fleets

The death toll from a powerful explosion at Iran's biggest port of Bandar Abbas has risen to at least 40, with more than 1,200 people injured, state media reported on Sunday, as firefighters worked to fully extinguish the fire.Saturday's blast took place in the Shahid Rajaee section of the port, Iran's biggest container hub, shattering windows for several kilometres around

U.S. proposals to hit Chinese vessels with high port fees would have a major impact on all firms in a container shipping industry in which most vessels are built in China, French-based shipping firm CMA CGM said on Friday.The U.S. Trade Representative's office has proposed charging up to $1.5 million for Chinese-built vessels entering U.S.

Asia's crude oil imports are off to a weak start in 2025, as top importer China continues to buy less and new sanctions put the brakes on cargoes from the continent's top supplier Russia.Asia's imports for the first two months of the year are on track to be 26.17 million barrels per day (bpd), down 780,000 bpd from the 26.