U.S. President Donald Trump’s regulatory freeze has injected chaos and uncertainty into a number of lucrative American fisheries, raising the risk of a delayed start to the fishing season for some East Coast cod and haddock fleets and leading to overfishing of Atlantic bluefin tuna, according to Reuters interviews with industry groups and federal government employees.

New U.S. tariffs and escalating global trade tensions have reshaped vessel markets in the first half of 2025, curbing investment in some sectors while accelerating strategic orders in others, according to the Half-Year Market Report by Veson Nautical, a provider of maritime freight management solutions and data intelligence.The report states that U.S.

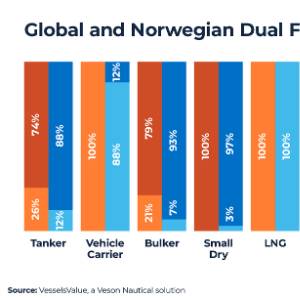

As the shipping world prepares to descend on Oslo for Nor’ Shipping 2025, we take a look at the Norwegian fleet which is currently valued at USD 66.2 bn using VesselsValue data. The following charts highlight the Norwegian fleet breakdown by vessel type, top Norwegian companies, S&P transactions, and the breakdown of dual fuel orders by sector.

A new memorial stone and plaque have been placed at the grave of Captain John King Davis, one of the mostly highly decorated navigators and mariners in the history of Antarctic exploration.Davis served as Chief Officer under Ernest Shackleton during the British Antarctic Nimrod Expedition in 1907 and captained the SY Aurora during the Australasian Antarctic Expedition in 1911

Using data from VesselsValue, a Veson Nautical solution, Rebecca Galanopoulos has analyzed the global container fleet, finding Swiss based MSC currently owns the most expensive fleet with a value of $49.6 billion.This company is also the largest in terms of vessel numbers with a total of 707 vessels, of which 584 are live and 125 on order.

The High Seas Treaty has reached the milestone of 60 state ratifications needed to trigger its entry into force.Sri Lanka, St. Vincent and the Grenadines, Sierra Leone and Morocco deposited ratification instruments at the United Nations General Assembly on September 19.Formally known as the Agreement under the United Nations Convention on the Law of the Sea on the Conservation and Sustainable

Coast Guard and Maritime Transportation Subcommittee Chairman Mike Ezell (R-MS) delivered his opening remarks at the July 22 hearing on the Federal Maritime Commission (FMC) budget request highlighting his interest in the impact of flags of convenience.The FMC is an independent agency responsible for the regulation of ocean-borne transportation in the foreign commerce of the United States.

The international treaty on the high seas, which focuses on conservation and sustainable use of maritime areas beyond national jurisdictions, has received sufficient support to take effect early in 2026, French President Emmanuel Macron said on Monday.Speaking at the third United Nations Ocean Conference in Nice, Macron said 55 countries' ratifications of the treaty have been completed

Energy firms have slowed construction of offshore wind farms in the U.S. for various reasons in recent years, including, most recently, opposition from U.S. President Donald Trump's administration.Offshore wind was a key pillar of former President Joe Biden's promise that fighting climate change will create jobs and invigorate the economy.

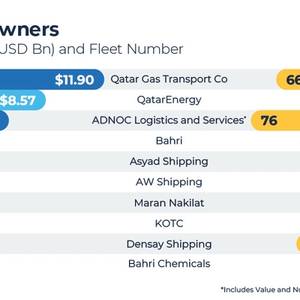

Qatar Gas Transport Co is currently the top Gulf Cooperation Council (GCC) company in monetary terms, with a live and on-order fleet value of $11.9 billion, reports Rebecca Galanopoulos of Veson Nautical.Based on VesselsValue data, the fleet consists of 36 live LNG and LPG vessels with a further 30 on order.