As oil exploration and production goes, so goes the market for Offshore Service Vessels (OSVs) and Platform Supply Vessels (PSVs). Throughout 2025, the prices of oil- which drives exploration and production (E & P), have softened, moving down towards $60/barrel amidst economic uncertainty and a wider than anticipated opening of the taps by major oil producers.

South Korea's HD Hyundai Heavy Industries, the world's biggest shipbuilder, said on Wednesday that it plans to merge with its affiliate HD Hyundai Mipo as it targets a bigger slice of the U.S. shipbuilding market.With the merger, the company said it aims to lead U.S.-Korea shipbuilding cooperation projects touted during a recent summit between the leaders of the countries that Seoul has dubbed

While global energy markets are not yet pricing in worst-case scenarios for the Israel-Iran war, oil tanker rates are providing a good real-time gauge of the escalating risks.Geopolitical risk has spiked following Israel's surprise bombardment of the Islamic Republic last Friday and Iran's retaliatory ballistic missile strikes, leading to a rally in global energy prices

U.S. President Donald Trump has hailed a deal led by U.S. firm BlackRock to buy most of the $22.8 billion ports business of Hong Kong conglomerate CK Hutchison which includes assets along the Panama Canal.The deal will give the U.S. consortium control of key Panama Canal ports amid White House calls to remove them from what it says is Chinese ownership.

Oil prices fell slightly on Monday after Iran said it had total control following the biggest anti-government demonstrations in years, easing some concerns over supply, while investors also weighed efforts to resume oil exports from Venezuela.Brent crude futures lost 28 cents, or 0.44%, to $63.06 a barrel by 1402 GMT while U.S. West Texas Intermediate crude was at $58.

This past year won’t soon be forgotten. In 2025, conventional thinking about economics and investor behavior was frequently challenged, as dramatic changes in technology, energy and geopolitics drove markets in often unexpected ways.As the clock turns to 2026, here are 8 general market movers that can help explain what happened in 2025 and what it might mean for 2026 and beyond.1.

Russia's Black Sea port of Novorossiysk temporarily suspended oil exports, equivalent to 2.2 million barrels per day, or 2% of global supply, on Friday, according to industry sources, after what local authorities said was a Ukrainian drone attack.The attack, one of the biggest on Russian oil-exporting infrastructure in recent months

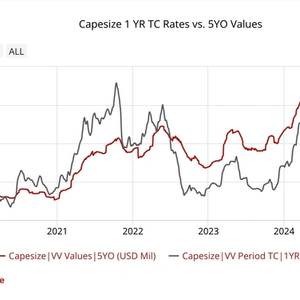

Global trade flows have adjusted to new geopolitical developments last week, with Red Sea diversions maintaining their grip on vessel demand patterns. Against this backdrop, timecharter earnings hit their highest levels since October 2024, with Capesize rates leading the rally while smaller segments lagged behind.

Global markets are getting too comfortable with risks like trade wars, geopolitical tensions and yawning government deficits, which, combined with already overpriced assets, increase the chance of a "disorderly" market correction, the International Monetary Fund said on Tuesday.Underscoring the IMF's warning

The Baltic Exchange’s main sea freight index rose to its highest level in a week on Monday, supported by gains across all vessel segments amid strengthening demand and firmer commodity markets.The overall Baltic Dry Index (BDI), which tracks rates for ships carrying dry bulk commodities such as coal, iron ore, and grains, climbed 9 points, or 0.6%, to 1,652.

CK Hutchison on Thursday reported an 11% drop in underlying profit for 2024, as one of Hong Kong's most powerful conglomerates becomes increasingly embroiled in a political row over the sale of its ports business to a BlackRock-led consortium.The telecoms-to-retail conglomerate, owned by billionaire Li Ka-shing, said this month it had agreed to sell most of its global ports business

Wind turbine maker Siemens Gamesa is in talks with Chinese suppliers of rare earth permanent magnets about the possibility of bringing production to Europe, in a bid to cut the region's reliance on imports after curbs on supplies from China.Delays in Chinese rare earth export permits have caused European car makers and their suppliers to scramble for alternatives in a market that is dominated by