The ABS Board of Directors has elected John McDonald as the new Chairman and Chief Executive Officer of ABS at a board meeting on November 11.In the culmination of a well-planned succession process, McDonald, the serving ABS President and Chief Operating Officer, will take over on January 1, 2026, when present ABS Chairman and CEO Christopher J. Wiernicki retires.

The impact of software on the performance of vessels and fleets was described by ABS Chairman and Chief Executive Christopher J. Wiernicki at a launch event in Greece for ABS Wavesight Advantage, a new intelligent platform.“In an industry where every ton and every ton-mile counts, ABS Wavesight Advantage puts the Power of One in your corner.

Colonna’s Shipyard is a fifth-generation, family-owned medium-sized shipbuilder, led by Randall Crutchfield, Chairman & CEO, today. Founded in 1875 by 26-year-old ship carpenter Charles J. Colonna with a $2,000 loan from his brother, he founded a company that has not only withstood the test of time

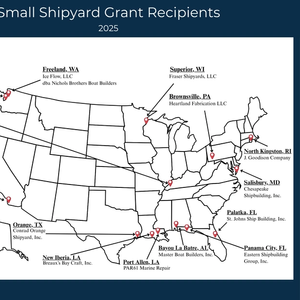

U.S. Transportation Secretary Sean P. Duffy has announced that the Maritime Administration (MARAD) has awarded $8.75 million in grants to revitalize U.S. shipyards and advance America’s maritime dominance.The funding is part of the Small Shipyard Grant program, which supports advanced training, workforce development and new technologies that strengthen U.S. shipbuilding and repair capabilities.

The final inter-array cable has been installed at Îles d’Yeu and Noirmoutier (EMYN) offshore wind farm in France, being developed by Les Éoliennes en Mer Services.The 61st and final inter-array cable was installed on June 22 at the EMYN offshore wind farm, Louis Dreyfus TravOcean said on social media.The accomplishment paves the way for a transmission capacity of 512 MW.

Louis Dreyfus Armateurs, a 170-year-old French family-owned company operating across a broad swath of maritime and offshore energy, recently announced a shipbuilding order and fleet expansion with the order for a series of three next generation SOVs, a series that will lean on five years of experience operating some of the first Hybrid-Electric SOVs.

At the 163rd ABS Annual Members Meeting, the classification society says it has never been stronger, with substantial growth and leading safety performance reported. Key numbers in 2004 included the fleet growing to 300 million gross tons, giving it pole position in global class in global new order share with 22 percent.

Louis Dreyfus Armateurs (LDA) and InfraVia, a private equity company in Europe, have entered into exclusive negotiations for InfraVia to acquire a majority stake in LDA, a group specializing in high value-added industrial marine services.LDA currently specializes in three growing segments, transportation and logistics of industrial equipment, mainly through dedicated Ro-Ro vessels

French ship owner Louis Dreyfus Armateurs (LDA) has selected SALT as the naval architect and Shanghai Zhenhua Heavy Industries Company (ZPMC) as the shipyard for the construction of three new service operation vessels (SOVs) ordered by Vattenfall.SALT, an offshore vessel designer and long-time partner of LDA, has been entrusted with the development of the new SOVs.

The Scythian philosopher Anacharsis (6th century B.C.) said: “There are three sorts of people: those who are alive, those who are dead and those who are at sea.”Many of those onboard the Nella Dan when she grounded in December 1987 never went to sea again. Such was their passion for the ship.

You would be hard pressed to find a corporate leader more passionate about the company they lead; more dedicated to the customer they serve. In this case it’s George Whittier, CEO, Fairbanks Morse Defense and the U.S. Navy. Upon his return less than five years ago, Whittier has driven FMD towards the top of the U.S. Navy supply heap, with a string of strategic acquisitions.

The Louis-Dreyfus family, shareholder of Louis Dreyfus Armateurs (LDA), and InfraVia Capital Partners, a leading independent private equity company in Europe, have completed the strategic transaction in which InfraVia, through its InfraVia European Fund VI, has acquired an 80% majority stake in LDA.