Amon Maritime was awarded investment grants of NOK 298 million ($29m) from Enova to support the construction of three new ammonia-fueled bulk carriers.The vessels, each in the Kamsarmax segment with a capacity of approximately 80,000–85,000 DWT, are designed to combine high energy efficiency with carbon free fuel.

Star Bulk Carriers reported a weaker third quarter amid softening dry bulk markets, lower charter rates and a smaller operating fleet, while continuing to reshape its fleet through vessel sales, refinancing and newbuilding acquisitions.The company posted net income of $18.5 million for Q3 2025, down sharply from $81.3 million in the same period last year. Voyage revenues also fell to $263.

Moran Towing Corporation acquired Bisso Towboat Co, as it aims to accommodate growing needs of New Orleans and the Lower Mississippi River communities.Moran was founded in 1860 and is privately owned and operated. It offers ship assist services in 17 ports along the U.S. East and Gulf Coasts and has operated in New Orleans since 2006.

Singapore-registered tanker Marine Dynamo and a Malta-registered bulk carrier Flag Gangos have collided south of Tanah Merah in Malaysia.Both vessels are stable, following the incident that occurred in the early hours of September 1, the Maritime and Port Authority of Singapore (MPA) informed.Light oil sheens have been sighted in the vicinity of Marine Dynamo.

The US Coast Guard and local partners are responding to an explosion aboard the 751-foot Liberia-flagged bulk carrier W-Sapphire in Baltimore Harbor.Responders from Coast Guard Sector Maryland - National Capital Region were dispatched to the area to assist. No injuries have been reported, and the cause of the explosion is under investigation.

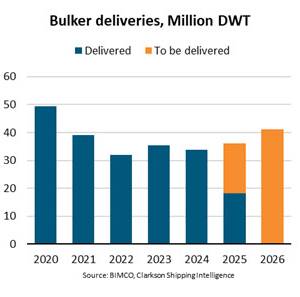

“We forecast that bulker deliveries will gradually increase this year and in 2026, reaching 41.2m Deadweight Tonnes (DWT) and a six-year high. Bulker newbuilding contracting was strong in 2023 and 2024, and several of the ships ordered during this period are expected to be delivered during this and next year,” says Filipe Gouveia, Shipping Analysis Manager at BIMCO.Of the 59.

Australia’s BHP Group has signed contracts with COSCO Shipping Bulk, a subsidiary of COSCO Shipping, for the charter of two ammonia dual-fueled Newcastlemax bulk carriers.The new vessels to be built under the arrangement will be two of only a handful of vessels in the world capable of using ammonia as a marine fuel.

On Friday, China announced a tariff increase of 34% on all US imports, in retaliation to the new tariffs announced by US President Donald Trump. These are in addition to tariffs implemented in February and March, focusing on goods such as grains, coal, LNG and crude oil.In 2024, China was the third largest importer of US exports (measured by value), accounting for 7% of US exports.

Belgian oil tanker group CMB.TECH has signed an agreement with Mitsui O.S.K. Lines (MOL) and MOL Chemical Tankers (MOLCT) for nine ammonia-powered vessels.The vessels will be among the world's first ammonia-powered Newcastlemax bulk carriers and chemical tankers. The delivery of these ships is expected between 2026 and 2029.The landmark agreement between MOL/MOLCT, and CMB.

Stena Bulk, the owner of the Stena Immaculate oil tanker, said it is working closely with the manager of the vessel Crowley and U.K. agencies following the last week’s allision with incident the container ship Solong.Salvage experts from SMIT Salvage are continuing with their detailed onboard assessments of Stena Immaculate.

Fears of an environmental disaster eased on Wednesday, two days after a container ship ploughed into a stationary U.S. fuel tanker off northeast England, as the vessel's owner said the detained captain was a Russian national.The Portuguese-flagged Solong had crashed with no obvious explanation into the larger Stena Immaculate, a tanker carrying jet fuel for the U.S. military.

The majority of the jet fuel aboard the U.S.-flagged tanker Stena Immaculate remains secure despite a collision with a container ship off the British coast, the tanker's owner, Stena Bulk, reported on Wednesday. Only two of the vessel’s 18 fuel tanks have leaked.The incident occurred on Monday when the Portuguese-flagged container ship Solong struck the Stena Immaculate