Japan's second-largest shipping company Mitsui O.S.K. Lines wants to tie up with Indian companies to build tankers in India, aiding the South Asian nation's effort to boost local manufacturing, its chief executive, Takeshi Hashimoto said.New Delhi is modernizing its maritime laws to allow foreign participation in the sector, including ship-building, ports and shipyards

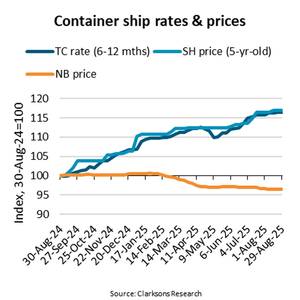

Despite significantly weaker freight rates, the average price for five-year-old container ships has increased 17% year-on-year and 6% since the beginning of 2025,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.The average per TEU price of a basket of seven five-year-old container ships was $9,761/TEU in late August 2024.

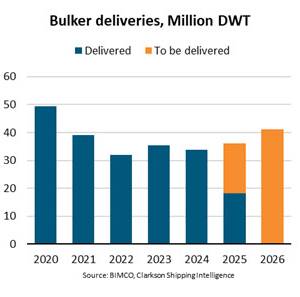

“We forecast that bulker deliveries will gradually increase this year and in 2026, reaching 41.2m Deadweight Tonnes (DWT) and a six-year high. Bulker newbuilding contracting was strong in 2023 and 2024, and several of the ships ordered during this period are expected to be delivered during this and next year,” says Filipe Gouveia, Shipping Analysis Manager at BIMCO.Of the 59.

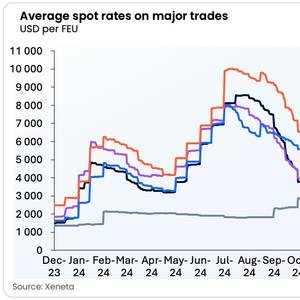

The prospect of a large scale return of container ships to the Red Sea following the announcement of a ceasefire between the US and Houthi militia in Yemen would flood the market with shipping capacity and cause a global collapse in freight rates, but the situation remains far from certain.

Two of the world's top shipping companies, Maersk and Hapag-Lloyd, said on Thursday they did not see an immediate return to Red Sea after the ceasefire between Hamas and Israel was announced.Both companies said they would be closely monitoring the situation in the Middle East and would return to the Red Sea once it was safe to do so."The agreement has only just been reached.

Dry bulk contracting falls 70% below average amid low rates.“Over the past three months, dry bulk newbuilding contracting has been 70% below the yearly average. Declining freight rates in recent months, a cloudy outlook and high newbuilding prices contributed to the slowdown, and contracting in 2024 will likely fall short of 2023 levels,” says Filipe Gouveia, Shipping Analyst at BIMCO.

Hapag-Lloyd's CEO said on Thursday he expects continued strength in container shipping volumes, which are driven by global demand for transporting goods and seen as a proxy for trade and a health barometer for the world economy.The volume of twenty-foot equivalent (TEU) containers moved by its 292 ships rose to 9.3 million metric tons in the nine months from January to September, up 5% from 8.

A.P. Moller-Maersk expects strong demand for shipping goods around the globe to continue in the coming months, though does not expect to resume sailing through the Suez Canal until "well into 2025".Attacks on vessels in the Red Sea by Iran-aligned Houthi militants have disrupted a shipping route vital to east-west trade

Liquefied natural gas shipping rates have hit multi-year lows and may extend losses going into 2025, analysts and shipping sources said, with new tankers being added at a faster rate than LNG production is rising and spot demand still tepid.New LNG tankers, built in anticipation of rising U.S.

International shipping company Hapag-Lloyd raised its full-year earnings guidance on Thursday citing stronger-than-expected demand and higher freight rates.Despite increased expenses from the diversion of vessels around the Cape of Good Hope, Hapag-Lloyd says it now expects earnings before interest, taxes, depreciation, and amortisation (EBITDA) for 2024 of between $4.

Danish shipping group A.P. Moller-Maersk said on Monday it had raised its full-year forecasts on the back of strong third quarter results, robust demand and the continuing disruption to shipping in the Red Sea.Maersk said it had revised its outlook for global container market volume growth in 2024 to around 6% from a range of between 4% to 6% seen previously.

Faced with an aging fleet, the Woods Hole, Martha’s Vineyard and Nantucket Steamship Authority has turned to converted offshore support vessels (OSV) to breathe new life into its ferry operations.The operator announced its purchase of the OSVs HOS Shooting Star and HOS Lode Star from Hornbeck Offshore Services in 2022, to replace its open-deck freight vessels Gay Head and Katama