The federal district court in Anchorage, Alaska, has entered final judgment against three Kodiak-based commercial fishing companies and their manager for multiple violations of the Clean Water Act.The court entered default judgments against company manager Corey Potter and F/V Knot EZ LLC, Aleutian Tendering LLC, and Alaska Tendering Company LLC, and imposed a civil penalty of $1,182

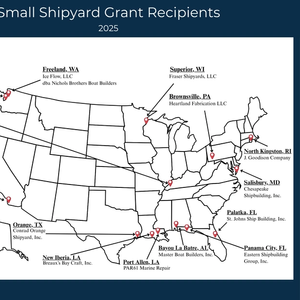

U.S. Transportation Secretary Sean P. Duffy has announced that the Maritime Administration (MARAD) has awarded $8.75 million in grants to revitalize U.S. shipyards and advance America’s maritime dominance.The funding is part of the Small Shipyard Grant program, which supports advanced training, workforce development and new technologies that strengthen U.S. shipbuilding and repair capabilities.

A towing incident has occurred on Saudi oil and gas drilling contractor ADES Holding’s jack-up barge Admarine 12, which capsized offshore Eqypt, killing four people, while three remain missing.The incident occurred on Tuesday, July 1, while the barge was being towed to a new location in Egyptian territorial waters.

Belgium-based offshore installation services company DEME has completed the acquisition Havfram, an offshore wind installation contractor based in Norway, in a deal valued at approximately $1.02 billion (€900 million).The transaction, first announced in April 2025, has passed all customary closing conditions.

A.P. Møller Holding has, through its wholly owned subsidiary APMH Invest (APMHI), made an all-cash voluntary recommended purchase offer to the shareholders of Svitzer Group to acquire all issued and outstanding shares of the company.A.P. Møller Holding, through its wholly owned subsidiary APMHI, currently owns 47% of the share capital and voting rights of Svitzer.

Fincantieri and Norwegian Cruise Line Holdings (NCL) have signed a multi-billion dollar agreement for the construction of four new cruise ships.With a gross tonnage of approximately 226,000 tons, the new units will be the largest ever built for NCL.The ships will be built at the Fincantieri Monfalcone shipyard, with the first unit to be delivered in 2030 and the others to follow in 2032, 2034

Seanergy Maritime Holdings Corp. has entered into two definitive agreements with unaffiliated third parties in Japan for the purchase of a Japanese-built Newcastlemax vessel and a bareboat charter with a purchase obligation for one Japanese-built Capesize vessel, for approximately $69 million.

Finland's public transport agency said that an oil tanker suspected of damaging undersea cables in the Baltic Sea was found to have serious deficiencies and will not be allowed to operate until repairs have been made.Baltic Sea nations are on high alert after a string of power cable, telecom link and gas pipeline outages since Russia invaded Ukraine in 2022.

As geopolitical tensions rise globally, and President Trump prepares to reenter the White House later this month, focus turns to the maritime sector and China's growing dominance. So when the U.S. Department of Defense released on the Federal Register on January 7, 2025 a "Notice of Chinese military companies operating in the United States

Abu Dhabi's Al Seer Marine, a subsidiary of International Holding Company (IHC), has taken delivery of two new Medium Range (MR) tankers, M.T. Saiph and her sister ship from K Shipbuilding Korea.Each vessel is equipped with an Exhaust Gas Cleaning System (EGCS) and engineered to accommodate alternative fuels such as Liquefied Natural Gas (LNG), ammonia, and methanol.

HII announced today that it has entered into a definitive agreement to acquire substantially all of the assets of W International SC, LLC and Vivid Empire SC, LLC (collectively “W International”), a South Carolina-based complex metal fabricator specializing in the manufacture of shipbuilding structures, modules and assemblies.

Investment holding company Ocean Wilsons has agreed to sell its 56.47% stake in Brazilian unit Wilson Sons to shipping services provider SAS for 4.35 billion reais ($764.9 million), it said on Monday.London-listed Ocean Wilsons, which is the controlling shareholder of shipping firm Wilson Sons, said in a statement it was a "compelling time" for the sale