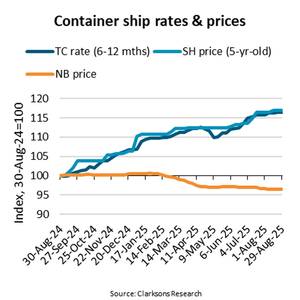

Despite significantly weaker freight rates, the average price for five-year-old container ships has increased 17% year-on-year and 6% since the beginning of 2025,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.The average per TEU price of a basket of seven five-year-old container ships was $9,761/TEU in late August 2024.

China’s share of the tanker orderbook rose from 32.4% in 2022, to 62.6% in 2023 and then 71.2% in 2024. Its share of the container ship orderbook has shown a similar growth trajectory. The nation has ranked first in the world for new orders since 2012. Labor costs are about half of what they are in Korea and Japan, and China is the world’s cheapest steel manufacturer.

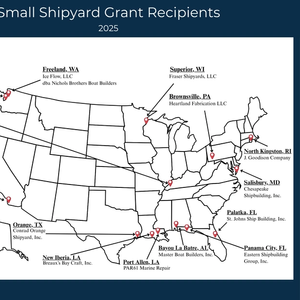

U.S. Transportation Secretary Sean P. Duffy has announced that the Maritime Administration (MARAD) has awarded $8.75 million in grants to revitalize U.S. shipyards and advance America’s maritime dominance.The funding is part of the Small Shipyard Grant program, which supports advanced training, workforce development and new technologies that strengthen U.S. shipbuilding and repair capabilities.

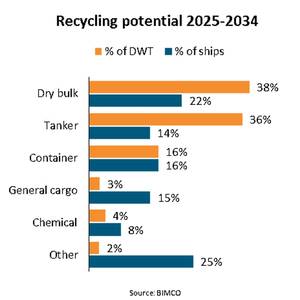

“As the Hong Kong International Convention for the Safe and Environmentally Sound Recycling of Ships (Hong Kong Convention) enters into force we have updated our estimate for the ship recycling potential over the next 10 years. We now estimate the potential to be 16,000 ships, or 700m deadweight tonnes (DWT), from previously 15,000.

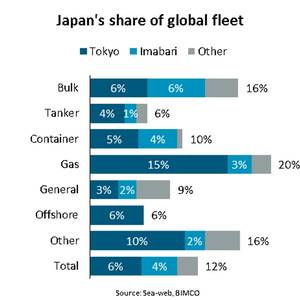

Japan is world’s third largest shipping nation as owners control 12% of the fleet“Combined, Japanese shipowners currently own 12% of the global fleet’s deadweight tonnes capacity (DWT). This makes Japan the third largest shipowning country in the world and one of only three countries where shipowners control more than 10% of the global fleet’s DWT capacity,” says Niels Rasmussen

On Friday, China announced a tariff increase of 34% on all US imports, in retaliation to the new tariffs announced by US President Donald Trump. These are in addition to tariffs implemented in February and March, focusing on goods such as grains, coal, LNG and crude oil.In 2024, China was the third largest importer of US exports (measured by value), accounting for 7% of US exports.

The global economy is bracing for renewed turbulence following U.S. President Donald Trump’s announcement on Wednesday of sweeping new tariffs, triggering fears of a global trade war and sparking immediate market and political reactions.According to the White House, the new measures include a 10% minimum tariff on most imported goods, with certain products - particularly those from major U.S.

Two of the world's top shipping companies, Maersk and Hapag-Lloyd, said on Thursday they did not see an immediate return to Red Sea after the ceasefire between Hamas and Israel was announced.Both companies said they would be closely monitoring the situation in the Middle East and would return to the Red Sea once it was safe to do so."The agreement has only just been reached.

“At the end of 2024, the container ship order book was 8.3m TEU, a new record compared with the previous high of 7.8m TEU in early 2023,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.As 4.4m TEU were contracted during 2024, the second highest ever, the order book grew despite deliveries hitting a new record high of 2.9m TEU.

China has allowed representatives from Germany, Sweden, Finland and Denmark to board a Chinese bulk carrier at the centre of an investigation into Baltic Sea cable breaches, the Danish foreign minister said on Thursday.The Yi Peng 3 vessel is wanted in Sweden for questioning over a breach of two undersea fibre-optic cables in November

Sweden is asking a Chinese vessel to return to Swedish waters to help facilitate the Nordic country's investigation into recent breaches of undersea fibre-optic cables in the Baltic Sea, Prime Minister Ulf Kristersson said on Tuesday.Two subsea cables, one linking Finland and Germany and the other connecting Sweden to Lithuania, were damaged in less than 24 hours on Nov.

Two undersea fibre-optic communications cables in the Baltic Sea, including one linking Finland and Germany, were severed, raising suspicions of sabotage by bad actors, countries and companies involved said on Monday.The episode recalled other incidents in the same waterway that authorities have probed as potentially malicious including damage to a gas pipeline and undersea cables last year and