In a move that further reshapes the global liner landscape, Hapag-Lloyd has agreed to acquire ZIM Integrated Shipping Services Ltd. in an all-cash transaction valued at approximately $4.2 billion, the companies announced today.Under the terms of the merger agreement, Hapag-Lloyd will acquire ZIM for $35.

Equinor said it is complying with a stop-work order issued by the U.S. Department of the Interior’s Bureau of Ocean Energy Management (BOEM), which ordered the suspension of offshore construction activities on the Empire Wind project citing national security concerns.Empire Offshore Wind LLC, the project company

Facility will include 150,000 square feet of covered manufacturing space optimized for serial productionNew yard will support 200 new jobs and expands shipbuilding capacity Master Boat Builders announced plans to build a new $60 million, 150,000 sq ft manufacturing facility dedicated exclusively to government and defense shipbuilding programs.

German container shipping firm Hapag-Lloyd on Thursday posted a 50% drop in nine-month net profit to 846 million euros ($986.6 million) and lowered the top end of its full-year earnings outlook, citing market volatility and rising costs.The company narrowed its full-year earnings before interest and taxes (EBIT) forecast to between 0.5 billion and 1.

A sanctioned liquefied natural gas (LNG) tanker made a ship-to-ship (STS) transfer off the coast of Malaysia after picking up a cargo from a Russian export terminal also under Western restrictions, according to two analytics firms.The operation appears to be the first known STS transfer of sanctioned Russian LNG, despite Western efforts to curb Moscow's energy revenues over its war in Ukraine.

Davie Defense Inc. gives a first glimpse today of the “American Icebreaker Factory” – a planned $1 billion transformation of the historic Gulf Copper shipyard in Galveston, Texas.The American Icebreaker Factory concept was created in collaboration with Florida-based Pearlson, which has led major projects for leading American shipbuilders, including BAE Systems

The federal district court in Anchorage, Alaska, has entered final judgment against three Kodiak-based commercial fishing companies and their manager for multiple violations of the Clean Water Act.The court entered default judgments against company manager Corey Potter and F/V Knot EZ LLC, Aleutian Tendering LLC, and Alaska Tendering Company LLC, and imposed a civil penalty of $1,182

The military and Coast Guard budgets are established that will benefit the U.S. ship building and repair sector, but what will stimulate the commercial yards?This author has been scratching his head of late, after a thrilling dive into July’s U.S. Big Beautiful Bill Act, and has asked several colleagues where the funding for support commercial shipbuilding can be found? To answer that

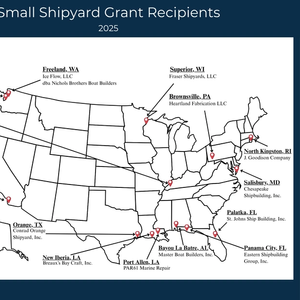

U.S. Transportation Secretary Sean P. Duffy has announced that the Maritime Administration (MARAD) has awarded $8.75 million in grants to revitalize U.S. shipyards and advance America’s maritime dominance.The funding is part of the Small Shipyard Grant program, which supports advanced training, workforce development and new technologies that strengthen U.S. shipbuilding and repair capabilities.

The Front Tyne oil tanker was sailing through the Gulf between Iran and the United Arab Emirates on Sunday when just past 9:40 a.m. shiptracking data appeared to show the massive vessel in Russia, in fields better known for barley and sugar beets.By 4:15 p.m., the ship's erratic signals indicated it was in southern Iran near the town of Bidkhun

Fugro has been selected by nonprofit organization Ocean Visions to lead the development of a standardized environmental impact assessment framework for marine carbon dioxide removal (mCDR), a set of emerging technologies that enhance the ocean’s natural ability to store carbon.The initiative aims to support the permitting of mCDR projects by providing a transparent

Inmarsat Maritime, a Viasat company, has announced Caribe Tankers USA, Inc (CTU) will trial Inmarsat’s fully managed bonded connectivity service, NexusWave, on board the chemical tankers Caribe Maria and Caribe Luna as the company seeks a reliable solution to best serve operational and crew connectivity.