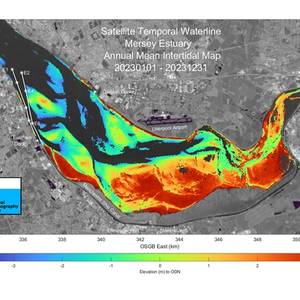

Scientists at the UK’s National Oceanography Centre (NOC) in Liverpool have used satellite data to create insight into the Mersey River that will help port operators be smarter about managing complex navigation channels. Through a project focused on Liverpool’s famous river and funded by the UK Space Agency

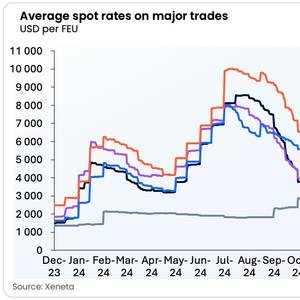

The prospect of a large scale return of container ships to the Red Sea following the announcement of a ceasefire between the US and Houthi militia in Yemen would flood the market with shipping capacity and cause a global collapse in freight rates, but the situation remains far from certain.

The US Coast Guard Station Sand Key and partner agency crews responded to a vessel collision involving the Clearwater Ferry and a recreational boat on Sunday evening off Clearwater Memorial Causeway Bridge in Florida. There were reportedly 45 people on the ferry and six people on the recreational vessel.

Taiwan prosecutors on Friday for the first time charged a Chinese ship captain with intentionally damaging undersea cables off the island in February, after a rise in sea cable malfunctions alarmed Taiwan officials amid tensions with China.Prosecutors say the man was captain of the Chinese-crewed Hong Tai 58, registered in Togo

Eastern Shipbuilding Group (ESG) has officially begun construction on the U.S. Army Corps of Engineers' (USACE) new medium class hopper dredger with a ceremonial steel-cutting event.The vessel is being built at ESG's Allanton and Port St. Joe facilities and is scheduled for delivery in 2027.ESG is collaborating with Royal IHC on the design.

Manson Construction has long been a pillar of the U.S. maritime industry, rooted in a tradition of U.S.-built, U.S.-owned, and U.S.-operated vessels. The company was founded in 1905 by Peter Manson, when he dug up a jar of gold coins [because he didn’t trust the banks] and purchased a winch, a winch that was then put on a barge and that became Manson's first pile driver.

Van Oord has secured a contract for the land reclamation of Naïa Island Dubai, a new development located just off Jumeirah’s coastline. The project marks another milestone in Van Oord’s long-standing presence in the region, following its role in the development of projects such as Dubai Harbor, the World Islands and Palm Jumeirah.

Peter Sand, Xeneta Chief Analyst, shared insights following the escalation of the Israel-Iran conflict.“Geo-politics is once again threatening the safety and stability of global supply chains so we must hope for de-escalation in the conflict between Israel and Iran, with concerns it could see a de-facto closure of the Strait of Hormuz—a vital entry point for container ships calling at ports such

TM Edison, a consortium of Belgian marine construction companies DEME and Jan De Nul, has installed the first two of a total 23 caissons in the Belgian North Sea, marking the start of construction for the Princess Elisabeth Island, the ‘world’s first’ artificial energy island.Caissons are concrete building blocks that form the outline of the future island.

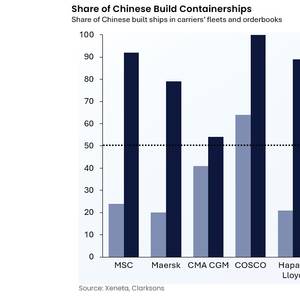

Analysts caution that a new proposal to impose fees on China-built container ships entering the U.S. could trigger unintended consequences, including port congestion, rising freight costs, and shifts in global trade flows.The Trump administration has announced a plan to charge a $1 million fee every time a vessel operated by a Chinese carrier docks at a U.S. port.

Volunteers helping to clean up a major oil spill along Russia's Black Sea coast appealed in a video released on Monday for President Vladimir Putin to urgently send federal aid, saying that they and local authorities were overwhelmed.The pollution, which has coated sandy beaches at and around Anapa, a popular summer resort

Donald Trump’s victory in the US Presidential Election is has importers on edge, fearing another spike in ocean container shipping freight rates premised on President Trump's vow on blanket tariffs of up to 20% on all imports into the US and additional tariffs of 60% to 100% on goods from China.