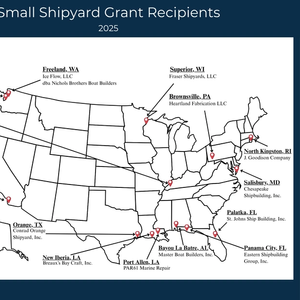

U.S. Transportation Secretary Sean P. Duffy has announced that the Maritime Administration (MARAD) has awarded $8.75 million in grants to revitalize U.S. shipyards and advance America’s maritime dominance.The funding is part of the Small Shipyard Grant program, which supports advanced training, workforce development and new technologies that strengthen U.S. shipbuilding and repair capabilities.

A tow pilot’s distraction caused by personal cellphone use resulted in a collision last year with moored barges on the lower Mississippi River, according to the National Transportation Safety Board.The towing vessel William B Klunk was pushing 22 loaded hopper barges on April 17, 2024, when the tow collided with moored barges at a fleeting area near Baton Rouge.

President Donald Trump's 'Big Beautiful Bill' earmarks more than $8.6 billion to increase the U.S. Coast Guard icebreaker fleet in the Arctic, where Washington hopes to counter rising Russian and Chinese dominance.The funding includes $4.3 billion for up to three new heavy Coast Guard Polar Security Cutters, $3.

Global insurer Allianz Commercial recently issued its 2025 Safety & Shipping Review, examining maritime risk trends and losses. The report revealed that the shipping industry has made significant improvements when it comes to maritime safety in recent years. During the 1990s the global fleet was losing 200+ vessels a year.

Louis Dreyfus Armateurs, a 170-year-old French family-owned company operating across a broad swath of maritime and offshore energy, recently announced a shipbuilding order and fleet expansion with the order for a series of three next generation SOVs, a series that will lean on five years of experience operating some of the first Hybrid-Electric SOVs.

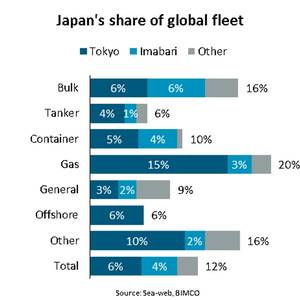

Japan is world’s third largest shipping nation as owners control 12% of the fleet“Combined, Japanese shipowners currently own 12% of the global fleet’s deadweight tonnes capacity (DWT). This makes Japan the third largest shipowning country in the world and one of only three countries where shipowners control more than 10% of the global fleet’s DWT capacity,” says Niels Rasmussen

In the ever-evolving world of maritime trade, ship ownership is a key indicator of economic influence and global commerce. As we enter 2025, Veson Nautical offers its Top 10 Ship Owning Nations, offering a detailed analysis of fleet values and industry shifts. This year, China has surged to the top, overtaking Japan in total fleet value

Seanergy Maritime Holdings Corp. has entered into two definitive agreements with unaffiliated third parties in Japan for the purchase of a Japanese-built Newcastlemax vessel and a bareboat charter with a purchase obligation for one Japanese-built Capesize vessel, for approximately $69 million.

James Fisher and Sons has ordered four new LNG dual-fuel tankers from China Merchants Jinling Shipyard (Yangzhou) Dingheng as part of its ‘fleet of the future’ business strategy.The new tankers, which will carry oil products and IMO Class II chemicals, will have LNG dual-fuel propulsion capability

The domestic passenger vessel answers the call for cleaner and more efficient platforms. It is truly an electric time to be a part of this niche industry.In the shadow of a rapidly changing political landscape, the domestic passenger ferry sector is nevertheless seeing an increasing number of newbuild vessel orders.

“At the end of 2024, the container ship order book was 8.3m TEU, a new record compared with the previous high of 7.8m TEU in early 2023,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.As 4.4m TEU were contracted during 2024, the second highest ever, the order book grew despite deliveries hitting a new record high of 2.9m TEU.

A.P. Moller - Maersk has signed agreements with three yards for a total of 20 container vessels equipped with dual-fuel LNG engines.Combined, the vessels have a capacity of 300,000 TEU.All 20 ships will be equipped with liquified gas dual-fuel propulsion systems and vary in size from 9,000 to 17,000 TEU.