Windward Offshore has taken delivery of its first Commissioning Service Operation Vessel (CSOV), Windward Athens, built by Norwegian shipbuilder Vard.The vessel represents a major milestone on Windward Offshore’s growth path and marks the company’s entry into operations with its dedicated CSOV fleet.

President Donald Trump's 'Big Beautiful Bill' earmarks more than $8.6 billion to increase the U.S. Coast Guard icebreaker fleet in the Arctic, where Washington hopes to counter rising Russian and Chinese dominance.The funding includes $4.3 billion for up to three new heavy Coast Guard Polar Security Cutters, $3.

Global insurer Allianz Commercial recently issued its 2025 Safety & Shipping Review, examining maritime risk trends and losses. The report revealed that the shipping industry has made significant improvements when it comes to maritime safety in recent years. During the 1990s the global fleet was losing 200+ vessels a year.

Louis Dreyfus Armateurs, a 170-year-old French family-owned company operating across a broad swath of maritime and offshore energy, recently announced a shipbuilding order and fleet expansion with the order for a series of three next generation SOVs, a series that will lean on five years of experience operating some of the first Hybrid-Electric SOVs.

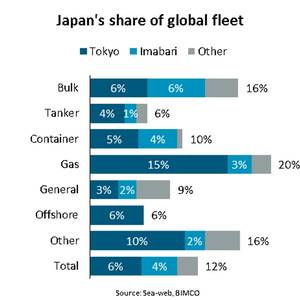

Japan is world’s third largest shipping nation as owners control 12% of the fleet“Combined, Japanese shipowners currently own 12% of the global fleet’s deadweight tonnes capacity (DWT). This makes Japan the third largest shipowning country in the world and one of only three countries where shipowners control more than 10% of the global fleet’s DWT capacity,” says Niels Rasmussen

In a move to restore full domestic ferry service by summer, Governor Bob Ferguson said that Washington State Ferries (WSF) will delay the hybrid-electric conversion of two of the state’s largest ferries. The decision comes as WSF works to increase its operational fleet, ensuring that 18 vessels are in service simultaneously for the first time since 2019.

Russia may be forced to reduce its oil production in the coming months as U.S. sanctions restrict access to tankers needed for exports to Asia, while Ukrainian drone attacks continue to damage key refineries.Last month, the U.S. imposed sanctions targeting 180 Russian tankers, coinciding with an escalation in Ukrainian drone strikes aimed at strengthening Kyiv’s bargaining position.

In the ever-evolving world of maritime trade, ship ownership is a key indicator of economic influence and global commerce. As we enter 2025, Veson Nautical offers its Top 10 Ship Owning Nations, offering a detailed analysis of fleet values and industry shifts. This year, China has surged to the top, overtaking Japan in total fleet value

Seanergy Maritime Holdings Corp. has entered into two definitive agreements with unaffiliated third parties in Japan for the purchase of a Japanese-built Newcastlemax vessel and a bareboat charter with a purchase obligation for one Japanese-built Capesize vessel, for approximately $69 million.

“At the end of 2024, the container ship order book was 8.3m TEU, a new record compared with the previous high of 7.8m TEU in early 2023,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.As 4.4m TEU were contracted during 2024, the second highest ever, the order book grew despite deliveries hitting a new record high of 2.9m TEU.

Hapag-Lloyd has ordered 24 new container ships from two Chinese shipyards with a combined investment volume of about $4 billion, it said on Wednesday.Twelve ships, each with a capacity of 16,800 TEUs (twenty-foot equivalent units), will be built by Yangzijiang Shipbuilding Group, while the other 12, with a capacity of 9,200 TEU each, will come from New Times Shipbuilding Company Ltd.

A new analysis from Windward reports a 20% decrease in the volume of direct oil voyages out of Russia in Q3 2024 compared to Q2.Q3 2024 marked the lowest monthly average of direct voyages from Russia to China since March 2023. When compared to Q2 2024 averages, there is a decrease of 12% in such voyages.